When Stability Backfires: When people think of Nestlé, they usually picture coffee jars, chocolates, or everyday kitchen staples not corporate drama. But behind the familiar products lies a storm that has shaken one of the world’s biggest consumer giants. The sudden firing of CEO Laurent Freixe has left the company scrambling to restore trust, stability, and direction.

A Leader Who Was Supposed to Bring Calm

Laurent Freixe wasn’t just another executive. After almost four decades with Nestlé, his promotion to CEO was meant to symbolize a return to stability. His predecessor, Mark Schneider, an outsider, had been bold, direct, and disruptive — a style that didn’t sit well with the company’s deeply traditional culture. Freixe, on the other hand, was sold as the “safe bet,” someone who would steer Nestlé back to its reputation of “boring predictability.”

But instead of calm, Freixe brought chaos. An internal probe revealed an undisclosed romantic relationship with a subordinate a direct violation of company policy. Worse still, he denied the allegations at first, only for a second investigation with external counsel to confirm them. For Nestlé’s board, the decision to fire him wasn’t about morality or prudishness. It was about broken trust, poor judgment, and a breach of integrity at the very top.

Business as Usual or a Missed Opportunity?

In an effort to show decisiveness, Nestlé moved quickly to appoint Philipp Navratil, a longtime insider, as CEO. The board’s message was clear: business must continue as usual. Navratil himself echoed that sentiment, promising full commitment to the company’s current strategies and performance plans.

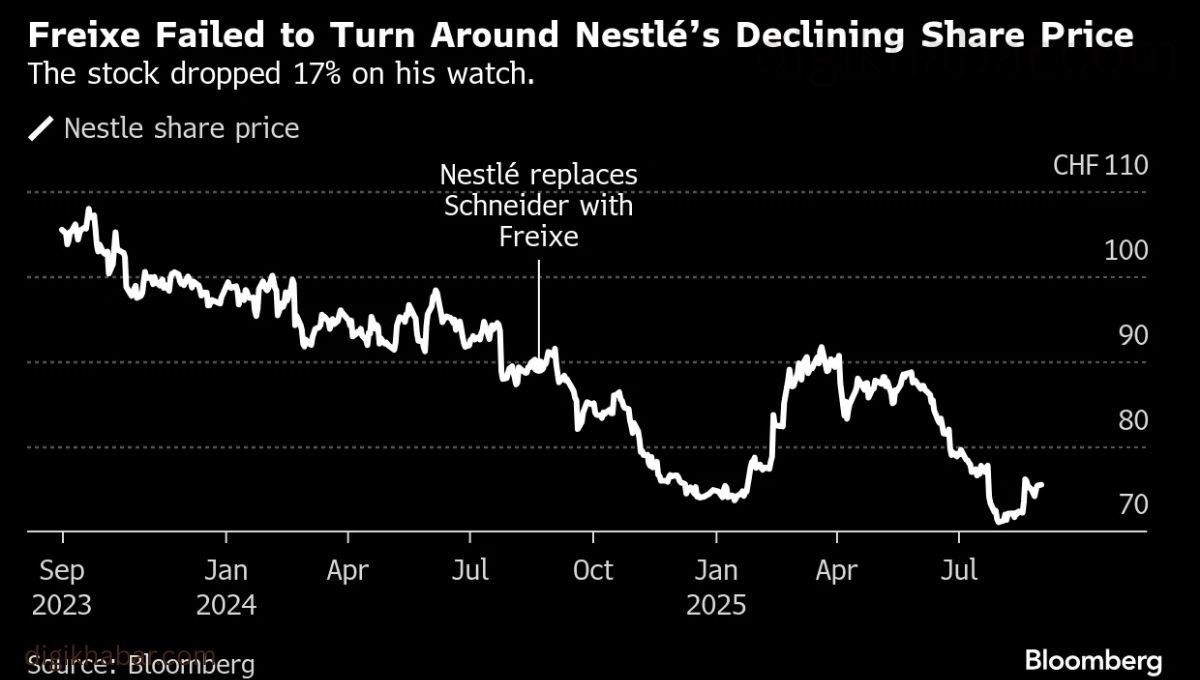

But here lies the real danger. Nestlé’s stock has lost nearly a third of its value in the past five years, with almost half of that decline under Freixe’s watch. Sales are slowing, and investors are restless. In this context, “business as usual” might be the riskiest path of all. Stability sounds good when things are strong. But when performance is slipping, stability without change feels more like stagnation.

Why the Safe Bet Can Be the Riskiest Choice

Freixe’s fall proves an uncomfortable truth: there is no such thing as a risk free CEO. Even the so called safe choices can hide vulnerabilities, whether in personal behavior, leadership style, or vision. By clinging to predictability, Nestlé’s board may have overlooked a bigger opportunity the chance to inject fresh energy, bold thinking, and innovation into a company that badly needs it.

Boards across industries are learning that ethical lapses aren’t isolated incidents. As one expert noted, when a leader bends one rule, it often raises the question: what else might they be willing to compromise? That’s why companies are less tolerant today, not because of corporate prudishness, but because leadership integrity sets the tone for the entire organization.

The Road Ahead

By removing Freixe swiftly, Nestlé’s board sent the right message about accountability. But its next challenge is much harder: deciding whether to continue clinging to tradition or to embrace the kind of transformation that could restore growth and confidence. Navratil may surprise investors by breaking out of the mold, but the signals so far suggest more continuity than change.

For a company as global and powerful as Nestlé, the stakes couldn’t be higher. Consumers may not feel these boardroom shifts immediately, but the long term direction of leadership will decide whether Nestlé stays relevant in a rapidly evolving market. Playing it safe, ironically, may be the biggest risk of all.

Disclaimer: This article is based on publicly available information and is written for informational and analytical purposes only. It does not represent investment advice or the official views of Nestlé or its affiliates.

Also read: US Stock Market Crash: S&P 500, Dow Jones, and Nasdaq Plunge From Record Highs